Pipeline Fellowship | Raising Women to Become Investors

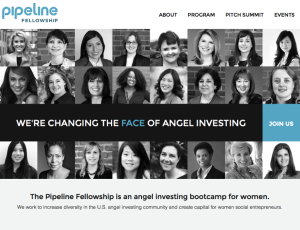

Men have dominated the world of investment. There have been only 22% women who invested in 2012. Natalia Oberti Noguera is on a mission to help change the demographic of investment with her Pipeline Fellowship. Pipeline Fellowship teaches women to become angel investors and become a more powerful and helpful voice in the investment world. Natalia not only wants to increase the number of women in investment, but bring more people in total to help startups and other businesses get the capital they need. TechZulu speaks with Natalia about Pipeline Foundation and her goals to change the face of business and investment.

Men have dominated the world of investment. There have been only 22% women who invested in 2012. Natalia Oberti Noguera is on a mission to help change the demographic of investment with her Pipeline Fellowship. Pipeline Fellowship teaches women to become angel investors and become a more powerful and helpful voice in the investment world. Natalia not only wants to increase the number of women in investment, but bring more people in total to help startups and other businesses get the capital they need. TechZulu speaks with Natalia about Pipeline Foundation and her goals to change the face of business and investment.

What is Pipeline Fellowship about?

Natalia Oberti Noguera: Pipeline Fellowship is a program to educate and bring more women into the investment side of business. There are not enough women in the world who are investing. We like to give women a chance to see and learn all about investing and what it takes to become an angel investor. We also want to create more capital for women entrepreneurs to increase the chances of being funded and connected to a bigger network.

Is Pipeline Fellowship national or global?

NON: We are planning to go global! I am half-Italian, half-Colombian. I am very aware of the power Pipeline Fellowship can have in other countries. Entrepreneurs are everywhere and capital isn’t. We get a lot more emails from women entrepreneurs who say there are high net worth women in their community and we should come and convert them to angel investors in their companies. That is something I am aware of. I’m passionate about women becoming angel investors. At the same time, I am committed to creating more capital for women entrepreneurs because they tend to not have easy access to capital and other people.

How many seminars does Pipeline Fellowship have?

NON: The commitment is two days a month for six months. We have three main components: education, mentoring, and practice. In terms of education, we hold workshops on topics like portfolio strategy and valuation. All our workshops are all led by experts, whether they might be seasoned angel investors or VCs. In terms of mentoring, we match Pipeline Fellows – “angels-in-training” with experienced angel investors who can share lessons learned. The third component is practice. I am a huge believer in “learn-by-doing”. People have to get in the game. It’s not just about hearing or learning angel investing. The women in the program commit $5,000 and invest as a group of woman in a woman-led for-profit social venture in exchange for equity. We generally have around 10 women in a group, equating to a minimum of $50,000 investment commitment.

What has been exciting is the ripple effect of putting 10 angels-in-training and 10 women social entrepreneurs together in the same room. In addition to the group investment, there are members of the Pipeline Fellowship who have individually invested in another company they have met through the Pipeline Fellowship Pitch Summit process. We are creating even more capital than the initial group commitment.

With respect to the practice component, we issue out a call for applications for women social entrepreneurs to apply to present at our signature event, the Pipeline Fellowship Pitch Summit. The selection process is entirely owned by the Pipeline Fellows who review the application and select 8-10 entrepreneurs to present at the Pipeline Fellowship Pitch Summit. After the event, Pipeline Fellows move forward with three companies and, as they’re learning how to perform due diligence, they apply lessons learned to these three companies and ultimately select one to invest in as a group in exchange for equity.

How hard was it for you to let women know about Pipeline Fellowship and join the program?

NON: I very much started with people in my network in the beginning. Here is a powerful story I like to share. One the Pipeline Fellows in our inaugural angel investing boot camps heard about Pipeline Fellowship through her father. Her father was reading an article about Pipeline Fellowship in Bloomberg Businessweek and he realized his daughter – who is an adult – may be interested in angel investing. What’s powerful is, her father is an investor and it wasn’t until he read about the Pipeline Fellowship that it occurred to him that his daughter might be interested in investing. They both talked about investing and about Pipeline Fellowship and she joined as a result of her father reading about us.

What reason would you give to our readers to join?

NON: I’m very passionate about getting more women angels. I would say, in terms of angel investing, it’s a great opportunity. I want to provide advice to women to realize it’s not just about the money; it’s the human and social capital they can bring to the table. For me, it’s very much showcasing that angel investing is not just writing a check, it’s so much more.

I know several women who have been mentoring entrepreneurs and I encourage them to step up to the plate. In addition to coaching and mentoring, I want to put them in the game of investing in startups.

Why is there such a huge discrepancy between men and women in investing?

Why is there such a huge discrepancy between men and women in investing?

NON: At the end of inaugural Pipeline Fellowship Conference, an all-day event on angel investing open to the public, a woman approached me and told me how she had been skeptical about being an angel investor. But when she saw panel after panel of women and people of color seasoned angel investors, she realized that she too could become an angel. As Marie Wilson as said, “You can’t be what you can’t see.” The Pipeline Fellowship has done a great job inviting women and women of color who were venture capitalists, angel investors, and other business professionals reassuring her that she wasn’t the only one in looking to be an angel investor.

For me, it’s also about creating a spotlight of women and people of color who are making an effort to increase the diversity in the VC and angel investing communities. The numbers are low, but they are not zero. If you look at the events out there and the people who are speaking at those events, it makes it seem that there is little to no diversity out there.

What other problems do you see women and women of color are facing in business in general?

NON: I judge a lot of pitch competitions and speak at a lot of conferences. Pitching isn’t a zero-sum game. The blogosphere’s full of posts on how women and people of color entrepreneurs aren’t getting funded. Another part of it is that women and people of color aren’t pitching. In 2012, only 16% of startups pitching to angels in the U.S. were women-led and only 6% were minority-led, according to the Center for Venture Research at the University of New Hampshire. Out of that 16%, 25% secured funding, and out of that 6%, 18% secured funding. There are several reasons why that might be happening. One of them is that some women and people of color entrepreneurs don’t realize that they have a business model that is scalable and they should consider VC and angel funding. Second reason, they’re not getting invited into the room to pitch. The third reason, I hear tons of entrepreneurs saying things like they are not ready yet. They think pitching means winning, or losing. I show them pitching isn’t a zero-sum game. Even if investors in the room might not be interested in an entrepreneur’s startup, by pitching, the entrepreneurs will be on the investors’ radar who might be able to connect them with potential investors they know who might be interested in their startup. Also, the feedback that entrepreneurs might receive from pitching their startup could get their business model closer to meeting market needs.

Do you think women aren’t informed or pitched to when it comes to investing?

NON: It’s a boys club when it comes to investing. Here is another story that I’m glad to share after I launched Pipeline Fellowship. I was invited to an angel investor network. They were having a meeting about whether or not to invest in a startup. There were 20 people in the room and I was one of the two women in the meeting. They were going around the room and each of the men -this was very hetero-normative- mentioned what their wife and her friends thought of the startup, or what their girlfriend and her friends thought of the startup. I realized that the women’s expertise was in the room even though they weren’t in the room. This is exactly why we need the Pipeline Fellowship because we need to get the women in the room.

Do women still hit a “glass ceiling” or has that phrase finally been put to rest?

NON: One of the things I will share is there is this whole conversation about sponsoring versus mentoring in the corporate sector. There are a lot of mentoring programs out there. What’s happening in these programs is affecting both men and women differently. Mentoring the men was all about getting them to person A or person B and getting them to this project or into this task force. It was very action-oriented. At the same time when it comes to mentoring the women, it was more about, “Well…we need to talk about your communication style”, where it was the opposite of action-oriented. There’s a parallel that can be drawn between the corporate and entrepreneurship worlds. It’s not just about mentoring women entrepreneurs, it’s also sponsoring them. The Pipeline Fellowship’s following the “sponsoring” school of thought of being action-oriented by creating more capital to fund their businesses. I would say there is a parallel that can be drawn in terms of women entrepreneurs and women of color entrepreneurs.

What would you like to tell our female readers who thinking about attending a Pipeline Fellowship event?

What would you like to tell our female readers who thinking about attending a Pipeline Fellowship event?

NON: Applications for our spring 2014 angel investing bootcamps in Boston, Chicago, DC, and NYC are being reviewed on a rolling basis. We invite you to apply.

What advice would you give to women about breaking gender barriers?

NON: I get asked a lot about how to get funding, investing, etc. If you want money, ask for feedback. People don’t realize at the end of the day, securing capital is about building relationships. It’s about building relationships with potential investors. Starting that conversation is the way to go. Sometimes people looking for help don’t want to bother those who want to help.

My feedback to them is, they offered to connect with you and I encourage you to send them an email. What’s the worst that can happen? They don’t reply? You are in the same place if you hadn’t sent out that email. At least you gave yourself a chance for them to reply, you are already in a better place than if you haven’t tried to contact them in the first place.

Thank you for your time Natalia.