WePay Takes on PayPal | Interview with Founders Bill Clerico & Rich Aberman

Formerly an area considered PayPal‘s domain, new companies are setting up shop in the online payments sector and capitalizing on what they say is the giant’s weaknesses.

Formerly an area considered PayPal‘s domain, new companies are setting up shop in the online payments sector and capitalizing on what they say is the giant’s weaknesses.

TechZulu caught up with the founders of WePay and bring you the latest.

What is WePay and why the name?

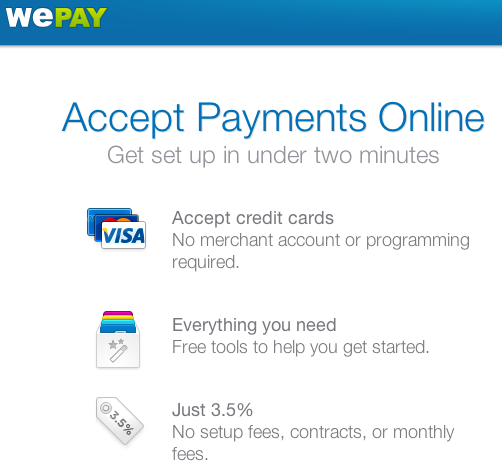

WePay is the easiest way to accept payments online.

We provides a suite of simple tools to allow individuals, small businesses, and non-profits to get up and running quickly and accepting payments online. Anyone can start sending invoices, selling tickets, setting up a store, or accepting donations in under minute.

It’s payments API allows platforms and marketplaces to accept payments for their customers without pre-existing merchant accounts. Shopping cart providers, website builders, and crowdfunding platforms, for example, can create accounts and facilitate payments for their users through the WePay API while limiting the scope of PCI compliance.

WePay was founded in 2008 by Bill Clerico and Rich Aberman and is headquartered in Palo Alto, CA.

The name came from the earliest iteration of our product, which helped groups of people pool money for shared expenses. Since then our product has shifted to serving individuals, small businesses, and non-profits.

When was it launched?

The company was founded in 2008 but launched publicly in March 2010

Who are the founders and what are their backgrounds?

Founders are Bill Clerico and Rich Aberman.Bill Clerico, CEO

Before joining WePay, Bill worked in technology investment banking at Jefferies & Company, where he advised enterprise software, digital media, and financial technology companies on M&A and capital market transactions. Previously, he worked for the U.S. Army’s Communications Engineering Research Command and in electronic trading at Goldman Sachs.Rich Aberman, COO

Rich oversees the company’s product and marketing effort. Before joining WePay, Rich briefly attended NYU Law in the Academic Scholars Program in Law and Business. BusinessWeek named Bill and Rich two of the Best Young Tech Entrepreneurs of 2011.

Key features and how does it work?

WePay provides a suite of simple tools to allow individuals, small businesses, and non-profits to get up and running quickly and accepting payments online. Anyone can start sending invoices, selling tickets, setting up a store, or accepting donations in under minute.

What inspired you to start WePay?

Poor experiences trying to collect money with PayPal. As college students trying to collect money for tutoring services PayPal was difficult to rely on for funds. The two also wanted technology that could help them collect money from friends for school/social groups and weekend trips.

What is your business model?

WePay charges 2.9% + $.30 per credit card transaction, or 1% + $.30 for bank transactions. No monthly, setup or hidden fees. We only make money when you make money.

Who is your target audience?

US-based small businesses, individuals, and non-profits.

Have you had any challenges?

Our biggest challenges to date have been making sure that the level of quality of talent we hire remains extremely high (it is very competitive in Silicon Valley), and that we continue to provide superior customer support as our user base grows.

How do you Compete with PayPal?

WePay provides a far superior user experience than PayPal. We offer users live customer support from representatives here in Palo Alto via chat, phone and email. When you’re dealing with people’s money that is very important. We also evaluate users’ online footprints along with traditional means to determine if they’re safe to underwrite for payments, which allows us to understand merchants better than PayPal and get people up and running much faster. WePay’s tools are also much easier to use. Anyone can be up and running and accepting payments in less than a minute. That is something PayPal cannot match.The high level of support customers receive, our advanced risk assessment technology, and the ability to get up and running quickly make for a far better user experience with WePay.

Any funding yet? If yes how much and by who?

$19.2 million dollars, from Highland Capital Partners, August Capital, Ignition Partners, Y Combinator, and several prolific angel investors including PayPal co-founder Max Levchin.

What’s coming next for WePay?

The world’s first Buy, Register and Donate buttons that allow anyone to accept payments on their own website without a redirect or writing a single line of code are coming Tuesday 8/28. Buttons make accepting payments as easy as embedding a YouTube video.

You can expect to see exciting things from us on the mobile and international fronts later this year.